Increasingly commentators in recent weeks have turned their attention to their crystal balls as they try and interpret new trends and behaviours. A growing sense of nostalgia and a return to normality is readily noted in any study of consumer behaviour. Activism is alive and well, with younger members of the community seemingly angrier than usual about history, and a range of injustices that they perceive have been inadequately addressed by the establishment. There is a general restlessness as people ponder what the future may hold. Media critics cannot contain their disappointment at the perceived failure for there to be any public debate on the virtues or otherwise of the lockdown. Factual reporting of statistics appears lost and COVID commentary seems to have retained its alarmist focus.

If you are not in the food business retail and consumer marketing is more challenging than ever. Boston Consulting group in their COVID-19 Australian Consumer Sentiment Snapshot, released in May, suggests Australian consumers are looking for a simpler way of life. The Chinese and Australian government spate appears to have increased the willingness of Australians to buy local brands with 37% saying they would purchase locally-up 56% from 2016. Institutional brands in the healthcare, supermarket and government arena have achieved significant gains in trust. The pandemic has driven more baby boomers to buy online for the first time. Luxury brand spending is expected to fall by as much as 45%. Travel will be down by as much as 70%, but with an opening up of the state borders some improvement in domestic tourism will help industries in the hospitality and accommodation sectors.

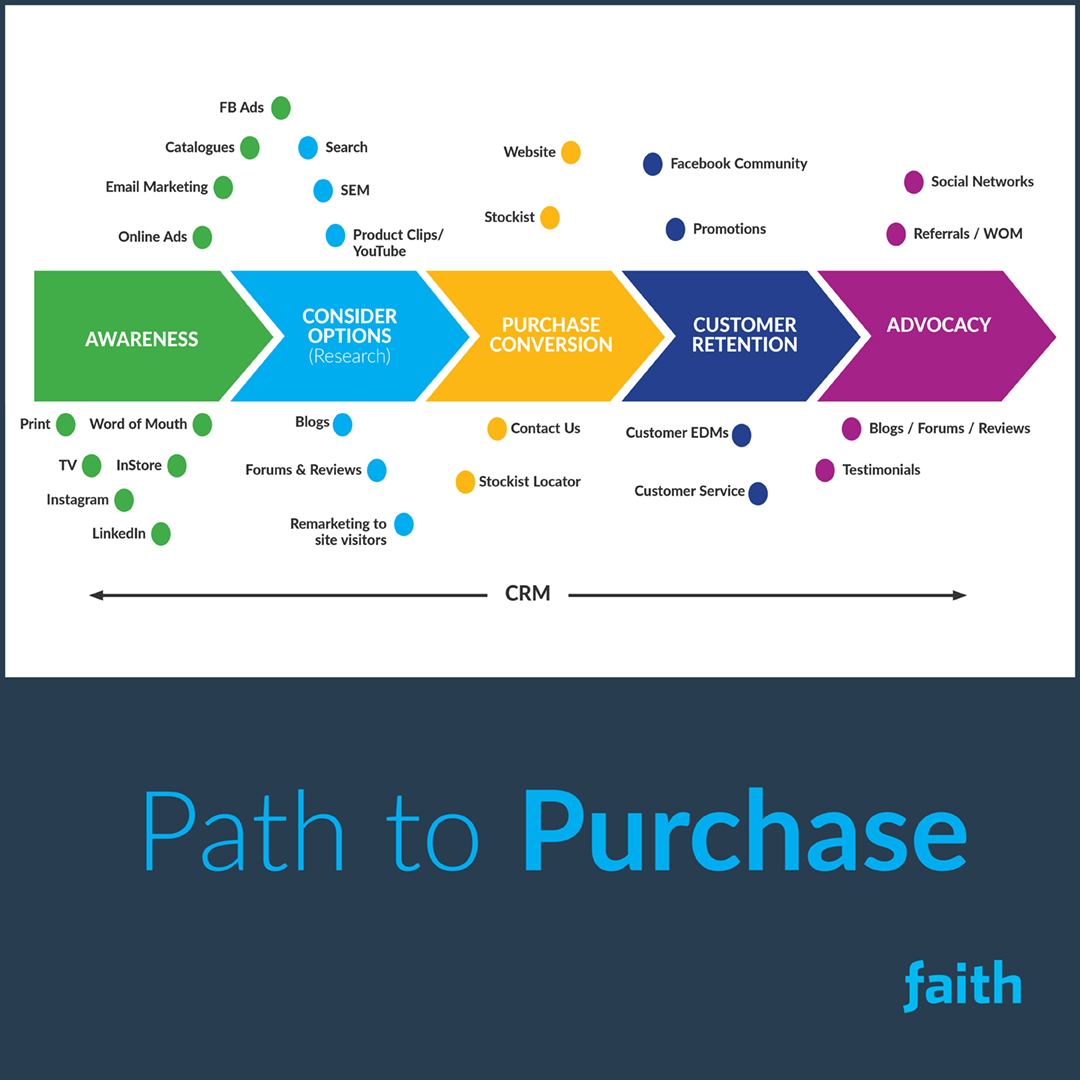

Whilst the business outlook, post Job Keeper, is unknown advertising continues to see a paradigm shift away from traditional channels to digital and social media platforms, at accelerated levels. Faith, media in gross terms is down over 30% YTD with most clients cancelling and postponing their planned activity in the second quarter of this year. With retailers re-opening their ‘bricks & mortar’ stores we expect a reluctance to return to normal levels of marketing activity until the damage caused by the lockdown is assessed.

The earliest improvement may well be the pre-Christmas retail period, and that will depend on retail sentiment and the state of the job market. Potentially catalogue advertising will lift in the next few months, but is unlikely to be to the levels of 2019 as many retailers are still re-establishing their supply chains and working out their inventory levels. SEO and paid search activity will continue to strengthen.

Australia Post has reported that online retailing has increased by 80% during the pandemic. That has increased client website activity with the focus on design and content very strong. The real debate for many retailers is now ‘How many stores do I need as a retail footprint with the shift that has occurred to online retailing’? The answer to which will have a major impact on the health of the industry and the prospects for retail advertising in 2020/21